what is fsa health care 2022

Generally FSAs can be used to reimburse costs for dependent care adoption or medical care but you cant do all three with one FSA. Medicated facial cleansers and pads.

Best Deals And Coupons For Oakley Oakley Fun Sports Snowboard Goggles

Your FSA account funds reset each year.

. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. 125i IRS Revenue Procedure 2020-45. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. Employees can elect up to the IRS limit and still receive the employer contribution in addition. Effective January 1 2022 the following will be the new limits.

If you have a dependent care FSA pay special attention to the limit change. You contribute funds to an HSA and FSA but only your employer can contribute to your HRA. Ad View Golden Rule Ins Co Short Term Plans To Help Bridge Gaps In Health Coverage.

Apply For Next Day Coverage. Easy implementation and comprehensive employee education available 247. You can choose to add any amount up to this limit.

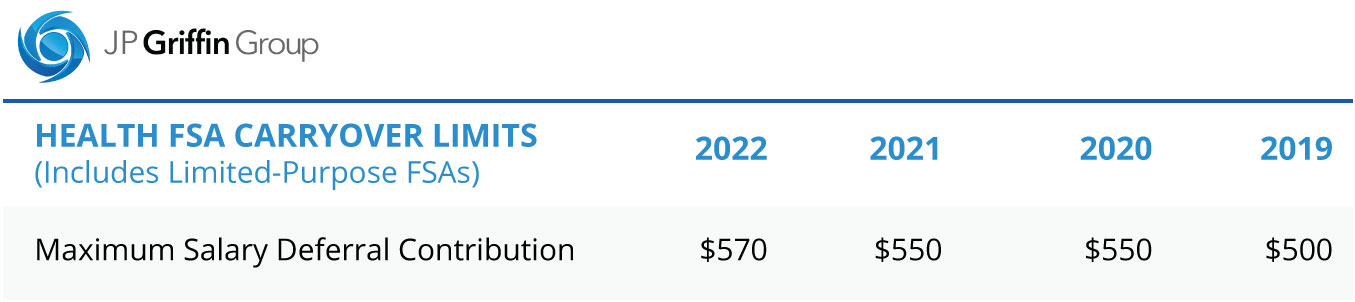

Eye creams and dry eye relief medications. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. In addition as part of COVID-19 relief the.

10500 Qualified CommuterParking Benefits. Ad Search top Medicare plans in your area. Maximum Healthcare FSA Carryover.

Healthcare FSAs are a type of spending account offered by employers. Get a free demo. An FSA is a type of savings account that provides tax advantages.

The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. For 2022 the maximum amount the IRS allows you to contribute to your healthcare FSA is 2850. Shop Budget-Friendly Golden Rule Ins Co Plans All Year.

FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. Flexible spending accounts FSA have been in the spotlight lately. 37 FSA eligible items to spend your FSA dollars on.

You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. Many FSA-eligible items fall into the skin care category which includes a slew of nonprescription skin and lip treatments. The 2022 Affordable Care Act ACA out-of-pocket maximums were also released earlier in the year by the Centers for Medicare and Medicaid Services CMS in the Notice of.

The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

Later you can use this money to pay for qualified expenses such as medical care health-related products and other services. Employers can offer either option for a. This is a win for many Americans whove had to deal with drug price increases and rising out-of-pocket costs.

Employers set the maximum amount that you can contribute. An FSA is a tool that may help employees manage their health care budget. But if theres still money in your.

Medicare Advantage Part D and MedgapSupplement plans. Health Care FSA. Ad Custom benefits solutions for your business needs.

If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. If you have adopted a 570 rollover for the health care FSA in 2022 any. FSA contributions are untaxed.

Heres how a health and medical expense FSA works. Any unused fsa dollars at the end of the year can be used until march 15 th 2023 to pay for 2022 eligible expenses bek health care fsa pay for eligible medical dental or vision expenses deductibles copays rx such as insulin otc medications if you enroll in the bek ppo medical plan The 2022 limits as compared to the 2021 limits are. Acne washes and creams.

Unlike a regular health FSA this employer-sponsored. You bought new eyeglasses squeaked in a dental appointment and stocked up on over-the-counter drugs. A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP.

The IRS allows you to roll over a maximum of 570 of unused funds to your next years FSA balance. Its a smart simple way to save money while keeping you and your family healthy and protected. Elevate your health benefits.

For Example Joe and Susan both have money left in their. All Products Are FSA-Eligible. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing.

In July 67 brand drugs increased by. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. Like health care FSAs dependent care accounts are offered by employers to allow workers to set aside pretax money in this case to cover the expenses of caring for children or other family.

You dont pay taxes on this money. With a health care FSA only employers can allow you to carry over up to 570 from 2022 to the following year. Plus if you re-enroll in FSAFEDS during Open Season you can.

Pre-tax dollars are put aside from your paycheck into your FSA. The Medicare tax is 145 for all of your income and if you make more than 200000 you pay an additional 09. Your employer may also choose to contribute.

When used it can be a great tax savings tool to effectively pay for. These accounts are typically combined with a health savings account HSA to help families increase their healthcare savings during the year. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020. With HRAs employers may limit which health expenses are eligible and the amount. But the late announcement left.

However it cant exceed the IRS limit 2750 in 2021. In 2021 the social security tax is 62 for the first 142800 in income. An FSA is a tool that may help employees manage their health care budget.

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. Browse compare plan options. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

An FSA is not a savings account. The COVID-19 pandemic paved the way for expanded FSA benefits such as coverage for pain relief medications and allergy products without a prescription. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses.

Buy Coloplast Brava Lubricating Deodorant Odor Remover In 2022 Deodorant Odor Remover Lubricants

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2022 Fsa Contribution Limits Are Here

Best Deals And Coupons For Polar Electro Polar Electro Polar Fitness Wearables

Irs Releases Fsa Contribution Limits For 2022 Primepay

Best Deals And Coupons For Fsa Store Learning Centers Health Conditions Learning

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

Fsa Carryover What It Is And What It Means For You Wex Inc

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Walgreens Tubular Stretch Net Bandage In 2022 Walgreens Bandage Sore Throat Relief

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Contribution Limits For 2022 Goodrx

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

We Offer Individual Health Insurance Family Floater Health Cover Extended Health Insurance And Wome Best Health Insurance Infographic Health Health Insurance

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Clearclub Multi Color Guards In 2022 Dental Guard Guard Mouth Guard

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Best Deals And Coupons For Lenscrafters Lenscrafters Sale Design Sunglasses Branding